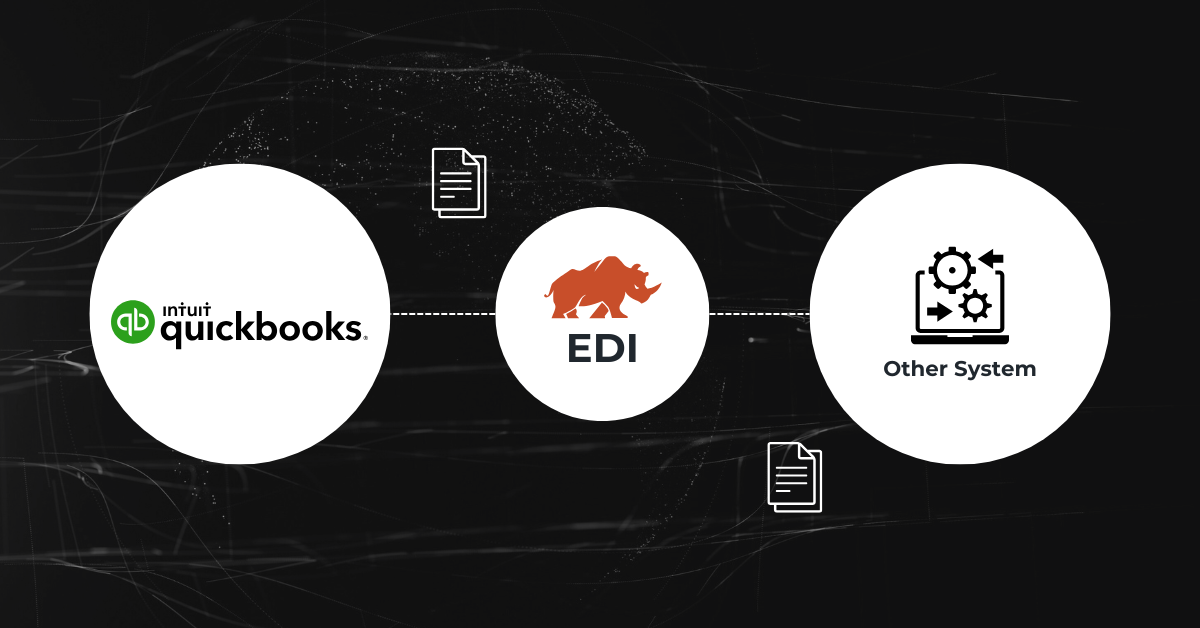

QuickBooks EDI (Electronic Data Interchange) integration enables businesses to automate the exchange of documents like invoices, purchase orders, and shipping notices between QuickBooks and your trading partners.

Instead of manually entering this data, EDI integration allows these documents to be sent directly into QuickBooks in a standard digital format, reducing errors and saving time. This is particularly helpful for small to medium-sized businesses, as it simplifies order processing and ensures faster, more accurate transactions, helping businesses run more efficiently and maintain better relationships with partners.

Methods Of QuickBooks EDI Integration

Here’s how you can facilitate EDI QuickBooks Integration:

Direct Integration (in-house)

In direct integration, you set up a direct, point-to-point connection between QuickBooks and your EDI vendor’s software. This connection is specifically between your QuickBooks software and the vendor’s system, without needing any extra middleman or third-party service.

The direct connection itself is facilitated through communication protocols like AS2, FTP, SFTP, or FTPS—each one designed to securely send and receive data. To make sure the data formats align, an EDI converter or translator is used. This tool maps the data from QuickBooks into a format the vendor’s system can read (and vice versa), so both systems can understand each other perfectly. Ideal for businesses with large transaction volumes with limited partners because each connection is built individually.

With direct integration, you’re in control, but it also means you’ll need internal resources, like your IT team, to maintain this setup.

Indirect (Outsourced) EDI

Here, you rely on a third-party service provider to handle the integration between QuickBooks and EDI. The following are comparatively affordable EDI solutions.

- Value Added Network (VAN): A VAN is a secure, private network where the provider manages the exchange of EDI documents between you and your business partners, handling everything from data translation to secure transmission.

- iPaaS Solution / Cloud EDI: Another popular outsourced option is using a cloud-based EDI platform. These providers offer an online solution that takes care of all EDI transactions and management. It’s flexible, scalable and hassle-free.

With indirect EDI, the provider takes care of most of the work, so it’s an easier option that lets you focus on your business instead of tech details.

Hybrid Integration

This approach combines direct and indirect methods. You may handle simpler EDI tasks in-house (like with an EDI translator) but rely on a third-party provider for complex integrations. Hybrid integration lets you stay flexible—keeping some control while outsourcing tougher tasks to specialists.

Also read: Magento EDI Integration Explained [Steps + Benefits + Use Cases]

Types Of EDI Solutions

Let’s look at the two main types of EDI solutions: web-based EDI and fully automated EDI.

1. Web-Based EDI: This is a simple, accessible solution where you use a secure web portal to send and receive EDI documents. With web-based EDI, you log in to an online platform to manually enter relevant data, such as purchase orders and invoices, which the system then translates into an EDI format. This type of EDI is ideal for smaller businesses or those with a lower volume of transactions because it’s affordable, easy to set up, and doesn’t require complex infrastructure. However, since it relies on manual labor, it can be more time-consuming and less scalable as your business grows.

2. Fully Automated EDI Solution: This solution takes the entire EDI process and automates it end-to-end, integrating it directly with your internal systems (like QuickBooks). With a fully automated setup, business documents are generated, translated, and transmitted automatically, without any manual entry. It’s highly efficient, reduces the risk of errors, and can handle large transaction volumes effortlessly. This option is ideal for larger businesses or those that deal with frequent, high-volume orders, as it streamlines business processes and saves time. However, it often requires a bigger investment upfront and IT resources to implement and maintain.

The key difference between the two is in how much they automate. With web-based EDI, the system handles EDI translation and conversion, but there’s still some manual work involved. In contrast, a fully automated EDI solution takes care of the entire process, including any linked systems. It streamlines everything from start to finish. With fully automated EDI, you can just sit back, relax, and let the system do the work. There’s no need for any manual input.

Also read: Salesforce EDI Integration Explained [Methods + Steps + Benefits]

What To Consider Before Choosing The Right Integration Solution

When choosing an EDI integration solution, here are some key points to keep in mind:

1. Technical Expertise

If you already have a strong IT team with EDI knowledge, a direct integration method could be the best fit. With this setup, your internal team can directly connect QuickBooks with the vendor’s software, handling the EDI mappings and protocols like AS2, SMTP, HTTP SFTP, etc.

However, if your business lacks an internal EDI Staff, consider the cost and resources of hiring outside help to manage a direct integration. In this case, outsourcing (indirect integration) may be simpler and more cost-effective.

2. Complexity Of Data Flows

For businesses with straightforward data needs and low transaction volumes, a web-based EDI might work just fine. You can manage the process through an online portal without needing a complex setup.

On the other hand, companies dealing with high transaction volumes or complex data flows might benefit from a fully automated EDI solution. This type reduces the risk of errors and saves time by automating data handling from start to finish.

3. Control And Flexibility

Direct integration allows for more control over your EDI process. This option suits companies that want to manage everything in-house and maintain direct oversight of their data flow.

If flexibility is important, you might consider hybrid integration, where you manage some parts in-house and outsource more complex tasks. This setup lets you keep control over simpler operations while outsourcing the more specialized ones.

4. Scalability

If your business is growing, ensure the EDI solution can scale with you. Automated solutions, especially those using cloud platforms, often handle business growth better since they’re designed to support increased transaction volumes seamlessly.

For smaller businesses that aren’t expecting rapid growth, a web-based EDI might be enough for now, with the option to upgrade as needs change.

5. Cost vs. Value

Evaluate the cost of the solution against the value it brings. For example, outsourcing may seem more costly upfront but can save on long-term IT maintenance and support.

Fully automated solutions may also carry higher initial costs but can bring long-term savings through efficiency and error reduction.

Each of these points helps you weigh the best option for your specific needs based on different factors. By considering these, you can pick a new reliable EDI system that aligns well with your organization’s needs and goals.

Also read: EDI Integrations Explained [Steps, Types and Benefits]

Challenges That May Arise During Integration

Here are the challenges you might face during integration and how to handle each one:

1. Data Incompatibility

- Challenge: One common issue is when data formats don’t match between your systems and EDI, causing delays and errors.

- Solution: Use a reliable EDI converter or translator that standardizes data for seamless integration. If you’re using a platform like the DCKAP Integrator, it manages this automatically, so you don’t have to worry about data mapping.

2. Limited Technical Expertise

- Challenge: If you don’t have an in-house IT team familiar with EDI, integration can feel overwhelming, especially since QuickBooks itself is not EDI compliant.

- Solution: A fully managed solution, like DCKAP Integrator, removes this stress by handling all the technical aspects for you. For other tools, consider hiring temporary technical help or a consultant for the initial setup phase.

3. Compliance and Security

- Challenge: Maintaining EDI and data security compliance can be challenging, especially for industries with strict data standards.

- Solution: Ensure you’re using an EDI provider that meets industry standards for security and compliance. A provider with a strong track record in these areas will give you peace of mind.

4. Scalability Issues

- Challenge: If your integration solution isn’t flexible, it might struggle as your business grows or adds new trading partners.

- Solution: Choose a system with flexible configuration options that can grow with your business needs, so you’re prepared for expansion.

5. Training and User Adoption

- Challenge: Implementing a new integration tool often requires team training, which can be time-consuming.

- Solution: Look for an EDI solution with a user-friendly interface and accessible customer support for ongoing help. Training sessions or guides can also help onboard your team faster.

Benefits Of QuickBooks EDI Integration

Here are the key benefits to consider:

- Automate Order Processing: With EDI, you can automate the flow of purchase orders, bills, and shipping docs directly into QuickBooks. No more manual data entry! This speeds up sales order processing and reduces errors.

- Manage Cash Flow Better: You’ll get invoices out and payments in faster. EDI helps keep the cash flow smooth, so you can track finances accurately and stay on top of your budget.

- Get Real-Time Inventory Updates: With EDI integration, you get instant access to real-time inventory data. So, you can avoid stockouts, make better demand forecasts, and stay on top of your stock levels with less hassle.

- Build Stronger Partner Relationships: Faster, more accurate transactions mean you’ll meet partner requirements easily. Your partners will appreciate the reliable communication, and it strengthens your business relationships.

- Save on Costs: Automation cuts down on paper, admin time, and the costs of fixing errors. This makes EDI a cost-effective way to handle your growing sales orders and processes.

- Easily Scale as You Grow: As your business grows, EDI can handle more orders and partners without adding more admin work. It’s built to support your growth smoothly.

QuickBooks EDI Integration With DCKAP Integrator

Since QuickBooks doesn’t have built-in EDI capabilities, it’s usually best to go with an outsourced EDI provider—meaning indirect integration. While QuickBooks can receive purchase orders through an EDI solution and automate electronic invoices, it falls short on handling Advanced Shipping Notices (ASN) (EDI Transaction 836) and specific warehouse instructions without using a report. These elements, especially the ASN and warehouse activities after order fulfillment, are crucial for EDI trading.

In this case, the ideal solution is DCKAP Integrator. It is a cloud-based fully automated EDI integration solution designed for manufacturers and distributors. This leading EDI provider

handles key EDI transactions like the 850 Purchase Order, 810 Invoice, and 856 ASN, ensuring smooth data flow between your trading partners. For EDI and order fulfillment, it provides a fully automated solution—so no manual work on your end. The system handles everything, keeping your data accurate and up-to-date across systems.

Here are a few more reasons why you should consider this tool:

- A unique benefit of the DCKAP Integrator is that it combines both integration and EDI translation in one tool. This eliminates the need for multiple vendors. If you already have an EDI solution and need to link it with QuickBooks, DCKAP can do that. And if you’re looking for both an EDI solution and integration with QuickBooks, DCKAP has you covered.

- This tool offers seamless integration with all other business systems, such as ERP, CRM, eCommerce, and Inventory management systems.

- DCKAP Integrator is a fully managed, fully automated service, so you don’t have to lift a finger. Our integration team handles everything, meaning you don’t need much technical expertise on your side. We’ll also take care of any automations required across your business systems, making it seamless. If you need additional integrations, we can do that too.

- One of its best features is the user- friendly intuitive interface, which is ideal for non-technical employees. Once the integration is complete and handed over, your staff will find it easy to use, whether they have technical expertise or not.

- Finally, there’s the support. We’re here to help whenever you need it, before or after integration, so you’re never left in the dark.

If you’re interested in learning more about DCKAP Integrator, book a free consultation today.

FAQs

What is QuickBooks, and why is EDI integration important for QuickBooks users?

QuickBooks is a popular accounting system designed for small to medium-sized businesses to manage finances, track sales, handle invoices, and streamline payroll. QuickBooks EDI integration enables data exchange directly with vendors, customers, and trading partners, reducing manual data entry, minimizing errors, and enhancing operational efficiency.

How do I integrate EDI with QuickBooks?

You can integrate EDI with QuickBooks using a simple cloud-based solution or an integration tool like DCKAP Integrator, which maps and automates data between QuickBooks and your trading partners.

QuickBooks Online vs. QuickBooks Desktop vs. QuickBooks Enterprise: What’s the difference, and which works best with EDI?

- QuickBooks Online is cloud-based, accessible from anywhere, and often simpler for small businesses. It’s compatible with many web-based EDI solutions but may have limitations for larger operations.

- QuickBooks Desktop is installed locally and offers more powerful inventory and financial features, making it suitable for businesses that need advanced EDI integrations with more control.

- QuickBooks Enterprise offers the highest level of capability, with extensive tools for larger companies managing complex operations. It’s often paired with advanced, fully automated EDI solutions to handle high transaction volumes, compliance, and support from different locations.

How do I know if I need a fully automated EDI solution or a web-based one?

- Fully Automated EDI is ideal if you need end-to-end automation with minimal manual input, especially for larger organizations.

- Web-Based EDI may work well for smaller businesses or those with lower transaction volumes, as it allows some manual input while still streamlining exchange of information.

What should I consider before choosing the right QuickBooks EDI integration tool vendor?

- Experience and Expertise: Look for a vendor with proven experience in EDI integration, especially in your industry.

- Training and Support: Ensure they offer comprehensive training and ongoing customer support, so your team is equipped to manage the system with ease.

- Data Security: Verify that the provider meets EDI compliance standards and uses strong security measures to protect your data, including customer information.

- Timely Setup and Results: Choose a vendor who can implement the integration in a timely manner and show quick results in operational efficiency.

- Powerful Systems: Look for robust and scalable systems that can grow with your business and handle increased transaction volumes.

- Flexible Configuration Options: Make sure the vendor’s solution is adaptable to your specific needs.

What industries can benefit most from QuickBooks EDI integration?

QuickBooks EDI integration is particularly beneficial in industries that rely on quick, accurate transactions and large order volumes. These include:

- Retail and ecommerce: Streamlines order processing, inventory updates, and invoice management.

- Manufacturing and Distribution: Automates workflows between suppliers, warehouses, and customers, enhancing operational efficiency.

- Healthcare and Pharmaceuticals: Ensures timely, accurate transaction processing and compliance with regulatory requirements.

- Logistics and Transportation: Facilitates seamless coordination between order management, shipping, and financial reporting.

How ERP-EDI Integration Works

ERP-EDI integration connects the ERP system with EDI, allowing seamless connections that automate data exchange and streamline EDI orders. By meeting specific data communication requirements, this integration formats data into a readable format for both systems, enabling real-time tracking and detailed information updates. Typically managed by EDI experts, setup is completed in a short amount of time and provides immediate improvements in productivity. ERP-EDI integration reduces manual effort, enhances efficiency, and supports smooth data flow—making it essential for organizations looking to optimize operations and simplify transaction management.