Securing interest in your product takes a lot of effort, all the more so in the B2B space. There’s a lot of planning, strategy, partners and vendors, marketing and sales initiatives, and so much more involved, all to ensure that people discover your products and are willing to part with their funds to make use of it.

Yet, your potential customer only truly becomes a customer once the sale is complete. Here, we’re discussing what will be the final stage in their online shopping journey, where interest turns into action: the payment gateway. Considering the fact that U.S. eCommerce B2B sales are projected to reach $1.8 trillion in 2023, it’d be remiss to not understand this pivotal step in the customer journey, and how you can choose the payment gateway that’s the best match for your online venture.

What are payment gateways?

Payment gateways are software that helps process online transactions. They connect the merchant website, app, or POS with the network of financial institutions leading to the authorization and completion of the payment. Some large multinational institutions have their own gateways that their customers engage with. However, other organizations enlist the services of various payment gateways technologies for the same, based on their clientele, goals, and budgets to name a few.

Payment gateways are not to be confused with payment processors. While the latter are tasked with analyzing and transmitting the information between merchants and financial institutions, payment gateways also authorize the transactions.

To understand them better, it’s best to also know of the process behind such transactions and how they interact with each other to lead to a smooth buying experience for the customer.

Online Payment Process

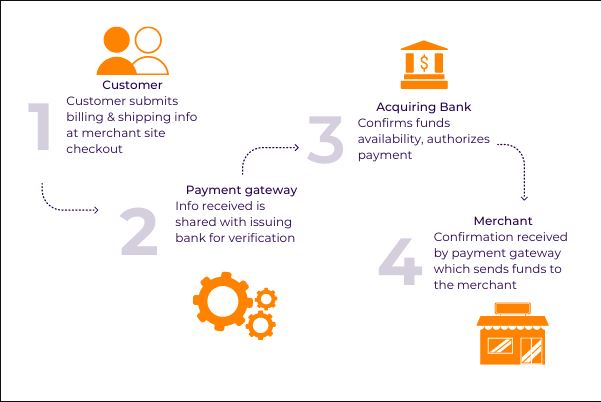

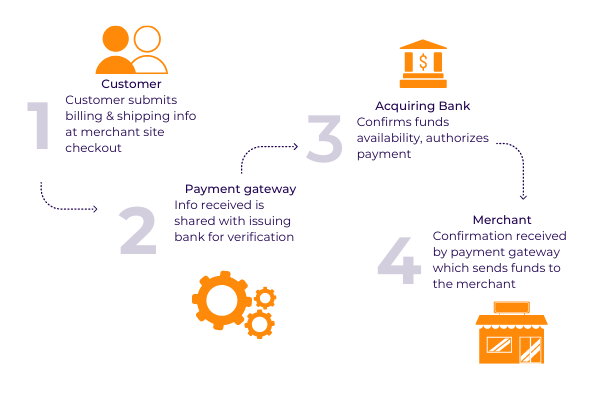

Say your customer has chosen their products and has reached check out. Hereafter to make a credit card payment, there are several steps involved, most of which take place in a handful of seconds. Here’s a simplified outline of this process for a successful transaction:

After having selected products they wish to purchase from the merchant website, the customer will be redirected to the checkout page. At this point, they will provide the requisite billing and shipping information

After having selected products they wish to purchase from the merchant website, the customer will be redirected to the checkout page. At this point, they will provide the requisite billing and shipping information- This information is passed by the payment gateway to the financial institution or the ‘acquiring bank’, to authorize the payment. This is done via the payment processor as well as the credit card associations.

- Once the transaction has been approved by the bank, this response is sent back to the payment gateway along with the funds for the purchase. In the event that the transaction has been declined, the reason behind the same will also be conveyed.

- Finally, once authenticated, the merchant can authorize the transaction to get the payment gateway to deliver the funds to the merchant account associated with it.

Recommended reads: 8 eCommerce Product Taxonomy Best Practices That Guarantee Conversions

Types of payment gateways

Hosted/Redirected payment gateways

These payment gateways redirect the customers to a secure portal to submit their details and complete the payment, hosted by a third-party service provider. Once the payment has been cleared, the customer will be redirected back to the merchant site. It is easy to set up, while providing the customer assured security and ease of use.

Onsite checkout & offsite payment

Here the customer is encouraged to provide their billing information, after which they are led to the third party site to authenticate the transaction. This method offers ease of use but does restrict the customization of the customer experience.

Non-hosted payment gateways

For merchants who prefer to have more control over the payment experience, they may choose to host the payment gateway, through APIs. While this does allow more customization, it also opens up the risk of payment failures as the entire process takes place at the checkout page.

Selecting the payment gateway for your business

As with most solutions available in the market, the selection of your payment gateway would be based on several factors with respect to the business it is being selected for. The industry has a whole host of options for payment gateways, which can leave you feeling spoilt for choice. Keeping the following criteria in mind should help you determine which payment gateway is the one you need:

Security features

This is the paramount cause of concern both for merchants as well as their customers. Concerns regarding data security are part of the internet experience, and customers would be much more willing to part with their money through this route, if they have been assured safety. The merchant site should be SSL (Secure Sockets Layer) certified. The site responsible for storing customer data must be PCI (Payment Card Industry) certified as well. It also helps to know the provider’s policy on data portability i.e., in the event that you discontinue their services, how would you be able to move customer data to your new platform.

Payment options

With fewer options, you run the risk of restricting your potential buyers to methods they may not currently have access to and thus losing business at the very last step of the process. Instead, by offering multiple options for payment, more customers may choose which they find most convenient. This includes the option of providing options for international transactions as well.

User experience

As one of the most decisive steps in the buying process, it’s best to opt for an option that provides a smooth and easy-to-use user experience. It should work well across devices, and can also be customized to suit your target audience. When using third-party gateways, it would help to have the interface match that of the merchant website as well to feel seamless at the customers’ end.

Merchant experience

Research regarding the experience of merchants opting for the payment gateway you’re deliberating upon. It would help to know which of the previously mentioned types of payment gateways you are interested in opting for. Check for ones that allow smoother and faster onboarding, security, effective reporting, prompt customer support, and a cancellation policy that works for you.

Pricing and costs

Seek a product with a pricing model that accommodates your requirements. Make sure to understand the various setup and processing fees that may be levied as well, to determine the final costs of the payment gateway you may opt for.

Conclusion

Payment gateways can be a game-changer for eCommerce businesses. They help allow fast transactions, convenience, can be deployed quickly, and allow a degree of flexibility in payment choices. However, no payment gateway is perfect and they do bring their own share of risks as well. Data security is still a concern today despite the advent of rapid technological advancements. There is also the possibility of glitches that may affect the customer’s ability to complete the purchase.

With the pandemic accelerating the decline of cash usage across the globe, providing the option for online transactions is now key to the success of your eCommerce business. The market for payment gateways in the United States is quite competitive, ensuring that there are plenty of options available for merchants to choose from.

And the right payment gateway can be just the solution for you to provide a happy shopping experience for your customers.

Contents