Electronic Data Interchange (EDI) is a structured method by which businesses can transmit data electronically from one business system to another, using standardized message formats.

This process facilitates the computer-to-computer exchange of purchase orders, invoices, shipping notices, and many other types of business documents.

In simpler words — think of EDI as a translator that allows different systems and applications across multiple platforms to communicate seamlessly.

Key Components of an EDI System

- EDI Software. This is the application that translates data from a company’s internal system (like purchase orders and invoices) into the standardized EDI format and vice versa. It can either be hosted on-premises or accessed via cloud services.

- Translation Software. Works hand-in-hand with EDI software to convert business documents into EDI formats and interpret incoming EDI files into a readable format for the business system.

- Communication Network. This serves as the pathway for transmitting EDI data between trading partners. The most common include Value Added Networks (VANs), Direct EDI (also known as point-to-point), AS2, FTP/Secure FTP, and increasingly, APIs.

- EDI Standards. These are the rules governing the structure and format of the EDI documents that ensure consistency across all exchanges. Common standards allow for interoperability between different systems and organizations.

- Integration Layer. This component integrates the EDI system with the internal applications like Enterprise Resource Planning (ERP) systems, accounting software, and inventory management systems, allowing for automatic data input and retrieval.

- Data Mapping Tools. These tools help in mapping the data fields in the company’s internal format to the corresponding fields in the EDI standard format.

Types of EDI Standards

- ANSI X12. Mostly used in North America, this standard is flexible and can handle data relating to various industries including finance, healthcare, transportation, and more.

- EDIFACT (Electronic Data Interchange for Administration, Commerce, and Transport). This is an international standard more prevalent outside of North America. It is used by organizations within the United Nations and covers a wide range of industries globally.

- TRADACOMS. Primarily used in the UK retail sector, it is an older standard and has been largely replaced by newer standards but is still in use for certain legacy systems.

- GS1 EDI. Developed by the global standards body GS1, this set of EDI standards is used in global supply chains, particularly in retail and healthcare, for transactional documents like orders, invoices, and logistics commands.

EDI Workflow: How EDI Integration Works

- Document Preparation. The first step in an EDI workflow involves preparing the business documents that need to be sent. These could be purchase orders, invoices, shipping notices, or any other type of business communication.

- Document Translation. Once the data is collected, it must be converted into an EDI format. Companies often use EDI translation software to convert their internal data format into an EDI standard format that can be understood by the receiving party. Common standards include EDIFACT, X12, and XML.

- Transmission. The EDI documents are then transmitted to the partner. This transmission typically occurs through one of several methods such as Direct EDI (Point-to-Point), EDI via VAN, or EDI via AS2/FTP which are secure Internet protocols.

- Receipt and Translation. The receiving party obtains the EDI document. Their EDI software translates the standard EDI format into a format that their internal systems can process.

- Acknowledgement. Often, the recipient sends back an acknowledgment document (like an EDI 997 functional acknowledgment in X12), confirming that they have received and successfully processed the EDI document. Both parties might use reports and dashboards to monitor EDI transactions and manage exceptions or errors in processing.

- Processing. Finally, the document is processed accordingly, triggering business processes such as order fulfillment, invoice payment, or inventory updates.

Related read: B2B EDI Integration Explained [+Top Solution for Distributors]

EDI Transaction Codes: ANSI X12 (U.S. Standard)

| Transaction Codes | Description |

| 810 | Invoice |

| 820 | Payment Order/Remittance Advice |

| 830 | Planning Schedule with Release Capability |

| 832 | Price/Sales Catalog |

| 840 | Request for Quotation |

| 843 | Response to Request for Quotation |

| 850 | Purchase Order |

| 855 | Purchase Order Acknowledgment |

| 856 | Advance Shipment Notice (ASN) |

| 860 | Purchase Order Change Request |

| 865 | Purchase Order Change Acknowledgment |

| 875 | Grocery Products Purchase Order |

| 880 | Grocery Products Invoice |

| 997 | Functional Acknowledgment |

Practical Example: A Retail Chain Ordering Stock from Suppliers

Let’s take a practical example of EDI in the retail industry to illustrate how businesses use it in their day-to-day activities:

Stage 1: Purchase Order Creation

- A retail store chain determines that its inventory of a particular product is low. The store’s inventory management system automatically generates a purchase order (PO) based on predefined stock levels.

- The PO is then formatted into an EDI document, specifically an EDI 850 (Purchase Order), using the store’s EDI software.

Stage 2: Sending the Purchase Order

- The EDI 850 document is transmitted to the supplier via a secure EDI network. The retail chain uses AS2, a common EDI protocol, to send this information securely over the internet.

Stage 3: Order Acknowledgment by Supplier

- Upon receiving the EDI 850, the supplier’s EDI system uses translation software to convert the EDI format into a format their order management system can process.

- The supplier’s system automatically checks product availability and generates an EDI 855 (Purchase Order Acknowledgment), which is sent back to the retailer, confirming receipt and acceptance of the order.

Stage 4: Shipping the Goods

- The supplier prepares the ordered goods for shipment. Once the goods are shipped, the supplier sends an EDI 856 (Advance Shipment Notice) to the retailer. This document provides detailed information about the shipment contents and expected delivery timing.

- The retailer’s system automatically updates the expected inventory levels and prepares for receiving the shipment.

Stage 5: Invoicing and Payment

- Upon receiving the goods, the retailer’s EDI system matches the shipment against the original EDI 850 and EDI 856 to ensure that the shipment is correct and complete.

- The supplier sends an EDI 810 (Invoice) to the retailer for the goods shipped. The retailer’s financial system processes the invoice and, after confirmation, executes payment through an EDI 820 (Payment Order/Remittance Advice), completing the transaction cycle.

Recommended: 6 Best EDI Integration Tools [+Top Choice for Distributors]

How to Set Up EDI Integration

Step 1: Assess Your Requirements

- Determine what kind of data you will be exchanging (e.g., invoices, purchase orders, shipping statuses), with whom (e.g., suppliers, customers) and the frequency (daily, weekly, or monthly).

- Some relationships might require real-time data exchanges, while others might be on a daily or weekly batch basis.

- Look at your current transaction volumes by analyzing internal records or ERP data. Identify peak times and average data loads to understand what your EDI system will need to handle.

| 💡 Pro Tip → Develop a comprehensive template that lists all potential EDI transactions and their attributes (e.g., mandatory, optional, conditional fields). This will help when configuring your EDI system to meet these specifications. |

Step 2: Choose an EDI Format

- Select EDI standards that fit your trading partner needs — and most importantly, your industry and region.

- For example, the healthcare sector in the US might use X12 because of specific requirements under HIPAA regulations, while international trade might lean towards EDIFACT.

- List all the types of documents you currently exchange with partners and identify their EDI equivalents. Common EDI Shipping documents include invoices (EDI 810), purchase orders (EDI 850), and advance ship notices (EDI 856).

| 💡 Pro Tip → If your partners use different EDI standards, consider implementing a flexible EDI software or service that can handle multiple formats easily. This flexibility can save time and reduce errors in the long run. |

Step 3: Select an EDI Integration Method

- Direct EDI/Point-to-Point. This allows for faster data exchanges and more control over the communications process. This can be beneficial for handling sensitive or large-scale transactions where timing and data integrity are crucial.

- EDI via VAN. VANs simplify the EDI process by managing the complexities of data exchange for you. This can be especially beneficial for businesses without the resources to manage their own EDI infrastructure.

- EDI Integration Service Providers. Many service providers offer cloud-based EDI solutions, which can provide scalability and flexibility without the need for substantial initial hardware investment.

- These providers typically offer integration capabilities with your existing ERP systems, automating data flow between systems and reducing manual data entry errors.

| 💡 Pro Tip → Before fully committing to a particular integration method, conduct a pilot test with a few key partners. This allows you to assess the practical implications of the method, including setup complexity, reliability of data exchange, and overall impact on your business operations. |

Step 4: Set Up EDI Infrastructure

- In-house vs. Outsourced. Decide if you want to manage your EDI in-house or outsource it to a service provider. In-house requires software installation and hardware setup, whereas outsourcing simplifies the technical complexity.

- Install the EDI software and configure it according to your chosen standards and formats. This includes setting up communication protocols and integrating with your internal systems (like ERP or accounting software).

| 💡 Pro Tip → If integration between EDI software and your internal systems proves complex, consider using integration middleware. Middleware can act as an intermediary layer that helps translate and transfer data seamlessly between different formats and systems. |

Step 5: Conduct Partner Onboarding

- Develop comprehensive documentation that includes all your EDI requirements, specifications, and standards.

- This should cover data formats, communication protocols, and any other technical specifications that your partners will need to know.

- Establish dedicated communication channels for EDI queries. This could be through a designated support email, a hotline, or a web portal where partners can get assistance and updates on the EDI process.

| 💡 Pro Tip → Organize workshops or training sessions for your partners, especially if they are less familiar with EDI. These sessions can help clarify the technical requirements and processes, ensuring that everyone is on the same page and reducing the likelihood of errors during the initial exchanges. |

Step 6: Test and Validate EDI Transactions

- Exchange test documents with trading partners to ensure compatibility and accuracy.

- Conduct end-to-end testing with your partners to ensure that the entire EDI process, from data entry through to final processing in your internal systems, works as expected.

- Verify that data is correctly translated and processed by both your systems and your partners’ systems.

- After each testing phase, gather feedback from your partners on any issues they encountered and any difficulties with the process.

Step 7: Transition to Live Environment

- Consider implementing a phased rollout where you begin by sending only a subset of your EDI transactions or start with less critical partners.

- Set up real-time monitoring tools that can alert you to transaction errors or delays as they occur. This allows for immediate intervention to resolve issues before they impact business operations.

| 💡 Pro Tip → Utilize EDI transaction management tools that provide dashboards and analytics to monitor the health and performance of your EDI exchanges. These tools can help identify patterns in errors and guide optimization efforts. |

Step 8: Maintain and Optimize

- Establish a regular schedule for conducting comprehensive audits of your EDI system’s performance. These audits should examine all aspects of the system, including data accuracy, transaction speed, and compliance with both internal standards and external regulations.

- Compare your system’s performance against industry standards or benchmarks to evaluate its efficiency. This could involve metrics like the error rate in transactions, the time taken for transaction completions, or the percentage of transactions processed without manual intervention.

| 💡 Pro Tip → Utilize advanced data analytics to mine EDI transaction data for insights that can drive optimization efforts. Analytics can reveal patterns in data usage and transaction flows that are not evident through casual observation. For example, data mining can identify recurring bottlenecks in data processing or typical errors that occur with certain types of transactions. |

Types of EDI Integration

Direct EDI (Point-to-Point)

Direct EDI (Point-to-Point) involves businesses transmitting documents directly to each other without intermediaries.

This type of EDI typically uses secure Internet protocols, such as FTP (File Transfer Protocol), SFTP (Secure File Transfer Protocol), or AS2 (Applicability Statement 2), to establish a direct connection between the trading partners’ systems.

How it works:

Both trading partners establish and configure their EDI systems to communicate directly with each other. This involves setting up the necessary software, choosing a communication protocol, and agreeing on the EDI standards and formats to be used (e.g., EDIFACT, X12).

- Pros. Direct EDI allows businesses complete control over their EDI processes and data, with increased security since data is transmitted directly between the parties without passing through third-party networks.

- Cons. As the number of trading partners increases, managing individual connections can become increasingly complex and inefficient. Each new partner potentially requires a separate setup and maintenance process.

Recommendation: Direct EDI is often best suited for businesses with a stable set of trading partners where large volumes of data are exchanged regularly, and both partners have the capability to support the technical requirements.

EDI via VAN (Value-Added Network):

This method uses a third-party network (VAN) that acts as an intermediary to facilitate the exchange of EDI messages between trading partners. VANs handle the complexities of data transmission, including security, compliance, and message tracking.

How it works:

Both trading partners subscribe to a VAN service and set up their connection to the VAN, which involves configuring their EDI systems to send and receive documents through the VAN.

- Pros. in terms of scalability, VANs can easily handle increases in EDI volume or changes in requirements without significant changes to the user’s existing systems.

- Cons. Using a VAN can be more expensive than direct EDI, as it typically involves subscription fees and transaction costs.

Recommendation: Direct EDI is suitable that need a simplified approach to EDI, those that deal with a wide range of trading partners (including international ones), or small to medium-sized enterprises that lack the infrastructure or expertise to manage direct EDI connections.

Web EDI

Web EDI refers to using web-based applications to facilitate EDI between trading partners. It allows companies to exchange EDI documents using standard internet browsers, without the need for specialized EDI software or direct data links.

How it works:

Businesses sign up with a Web EDI service provider. This involves creating accounts and configuring user settings to ensure security and compliance with their trading partners’ EDI requirements. They can either manually enter data into web forms that mimic standard EDI document formats or upload documents that are then converted into EDI format by the Web EDI service.

- Pros. Web EDI can be accessed from anywhere with an internet connection and does not require specialized EDI software or hardware, making it easy to use and reducing upfront costs.

- Cons. Web EDI does not offer the same level of functionality or customization as traditional EDI solutions. This can be a drawback for companies with complex integration needs.

Recommendation: Web EDI is ideal for companies that require a straightforward, cost-effective solution for exchanging standard business documents with their trading partners, particularly those new to EDI or with limited resources.

EDI Integration via API

APIs enable real-time data exchange and integration between different systems, making EDI data accessible within various applications like ERP systems, CRM, or accounting software.

How it works:

Developers create or configure APIs to handle specific EDI tasks, such as sending purchase orders or receiving invoices. This involves programming the APIs to understand and process EDI formats directly or convert between EDI and other data formats.

- Pros. APIs can be customized to handle various data formats and integrate with virtually any modern software system, providing greater flexibility than traditional EDI methods.

- Cons. Business processes become dependent on the stability and reliability of APIs. If an API fails or experiences issues, it can disrupt EDI transactions and related business operations.

Recommendation: EDI integration via API is great for businesses that need dynamic, real-time data exchanges with their trading partners. It’s ideal for environments where rapid response times and system flexibility are critical, such as e-commerce, supply chain management, and just-in-time inventory systems.

Also see: ERP Data Integration With Other Systems

Hybrid EDI

Hybrid EDI combines various EDI transmission methods to create a flexible, adaptable communication environment that caters to different business needs and partner capabilities. This approach might integrate direct EDI, EDI via VAN, Web EDI, and EDI integration via API, depending on the specific requirements of the trading partners involved.

How it works:

Companies assess the EDI capabilities and preferences of their trading partners and choose the most appropriate EDI methods for each relationship. This might involve setting up direct EDI connections with larger partners while using VANs or Web EDI for smaller partners or those with less technical capacity.

- Pros. Hybrid EDI allows businesses to accommodate the varied EDI capabilities and preferences of different trading partners, ensuring smoother and more efficient interactions.

- Cons. Using various methods may lead to challenges in maintaining data consistency and standardization across different EDI formats and systems.

Recommendation: Hybrid EDI is ideal for companies that engage with different types of of trading partners, each with different technological capabilities.

Mobile EDI

Mobile EDI refers to the use of mobile devices, such as smartphones and tablets, to exchange EDI documents between trading partners. This approach leverages mobile applications and cloud-based services to facilitate EDI transactions anywhere and anytime.

How it works:

Users install mobile EDI apps on their devices, which are configured to connect securely to their EDI network or service. This setup typically involves authentication procedures to ensure secure access.

- Pros. Mobile EDI provides the flexibility to manage EDI transactions on the go, enhancing responsiveness and operational efficiency.

- Cons. While mobile devices offer convenience, they can pose significant security risks if not properly managed, especially when transmitting sensitive business data.

Recommendation: Mobile EDI is suitable for businesses that need to manage transactions dynamically and from multiple locations, such as logistics, sales, and field services. It offers significant advantages in terms of mobility and real-time operations, making it an attractive option for modern businesses that prioritize flexibility and speed.

Challenges in EDI Integration

Complex Setup and Maintenance

EDI systems are known for their complexity, primarily due to the need to comply with various types of standards and protocols that differ significantly across industries and among trading partners.

This complexity stems from the requirement to precisely map data elements to meet compliance standards, facilitate accurate data exchanges, and ensure seamless integration with different business processes. Each EDI setup demands careful attention to detail to achieve efficient and error-free operations, adding to the challenges of setup and ongoing maintenance.

Solution

Leverage modern EDI software that comes equipped with built-in templates for common industry standards and visual mapping tools that simplify the translation of data formats. These tools can automatically generate mappings based on predefined rules, significantly reducing the manual effort involved.

Cost Implications

Implementing and maintaining an EDI system requires a considerable financial investment, which can be particularly challenging for smaller businesses. This includes purchasing EDI software or subscribing to a service, acquiring necessary hardware like servers and secure network equipment.

Additionally, the labor required for the setup and maintenance of the system adds to the financial burden. These significant cost implications can discourage businesses from adopting EDI, despite its potential advantages in streamlining operations and improving communication with trading partners.

Solution

Opt for cloud-based EDI solutions that reduce the need for initial hardware investments and offer pay-as-you-go pricing models to scale with business needs. Consider outsourcing to EDI service providers to further reduce costs.

Integration with Existing Systems

Integrating an EDI system with existing enterprise applications like ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and supply chain management systems poses significant challenges.

This integration is essential for automating business processes and ensuring seamless data flow between different systems.

However, the complex and often proprietary nature of these applications can make smooth integration difficult. This can lead to issues such as data silos and operational inefficiencies, complicating the seamless interconnection that businesses aim to achieve with EDI.

Solution

Choose EDI solutions that provide robust APIs and are compatible with a wide range of systems. Employ middleware that acts as a bridge between EDI and other business systems to streamline data flow and automate processes.

Related read: ERP Middleware: All You Need To Know [+FAQs]

Data Quality and Errors

Manual data entry is prone to human error, leading to significant issues such as order delays, billing discrepancies, and strained business relationships. Additionally, incorrect setup of EDI translation or mapping rules can cause data to be improperly formatted or placed in the wrong fields, creating confusion and transaction errors.

Furthermore, discrepancies in how different partners interpret or implement EDI standards can lead to inconsistent data exchanges. This inconsistency may result in data being misinterpreted, rejected, or processed incorrectly, causing financial losses and operational inefficiencies that negatively impact business performance.

Solution

Implement automated data validation checks within the EDI software to ensure that all transmitted data meets quality standards. Regular audits and feedback loops with trading partners can also help maintain data integrity.

Scalability Challenges

As businesses grow, scaling their EDI systems to handle increased transaction volumes and more complex data exchanges becomes challenging without degrading performance.

Scalability issues can cause system slowdowns, higher transaction errors, and difficulties in efficiently onboarding new trading partners. These problems can hinder a company’s bottomline and growth potential.

Solution

Adopt scalable EDI technologies that can grow with your business. Cloud-based solutions are particularly effective as they allow for easy scaling up of resources and can accommodate growth without significant additional investments.

Regulatory Compliance

Each industry has its own set of compliance standards (such as HIPAA for healthcare in the U.S., or GDPR for data protection in Europe). Understanding and implementing these requirements can be complex and resource-intensive.

For businesses operating across borders, compliance becomes even more challenging as they must adhere to the regulatory requirements of each country they operate in, which can differ greatly.

Solution

Use EDI solutions that automatically update to comply with the latest regulatory standards. Partnering with an EDI provider that focuses on compliance can also minimize the burden of staying current with regulations.

Partner Onboarding

Onboarding new trading partners involves configuring the EDI system to communicate effectively with the systems of new partners, each of whom may have different capabilities and requirements. Considering that not all partners may have the same level of technical resources dedicated to EDI, it further complicates the entire integration process.

The complexity of this process can lead to lengthy onboarding times, increased costs, and potential errors, all of which can strain business relationships and delay the realization of benefits from new partnerships.

Solution

Simplify partner onboarding by employing EDI software that offers flexible communication options and supports multiple standards. Establishing clear guidelines and support for trading partners during the onboarding process can also enhance efficiency.

Easy EDI Integration With DCKAP Integrator

Imagine faster transaction times, pinpoint data accuracy, and a workflow so smooth your team can finally focus on growing the business instead of juggling data. The DCKAP Integrator is your gateway to a streamlined, competitive edge.

With this powerful solution at your fingertips, you can automate routine tasks, reduce human error, and ensure that your data flows seamlessly across all platforms. This is more than just efficiency; it’s about transforming your operational capabilities to meet demands and exceed customer expectations.

Why Opt for DCKAP Integrator?

- Tailored to Your Needs: One of the most significant advantages of DCKAP Integrator is its ability to fit into your specific business requirements. No matter your industry—be it manufacturing, retail, or healthcare—the platform can be customized to fit your unique operational workflows and data formats, ensuring a seamless integration experience.

- Robust Integration Options: DCKAP Integrator supports several EDI standards, including ANSI X12, EDIFACT, and TRADACOMS, along with various communication protocols like AS2, FTP, and SFTP. This wide-ranging support facilitates effortless interactions between different systems, helping maintain smooth communications with multiple trading partners.

- Scalable Solutions: As your business expands, so do your needs. DCKAP Integrator is designed to grow with you, capable of handling an increasing volume of transactions without a hitch. This scalability ensures that your EDI capacity can keep up with your business growth without needing constant system upgrades.

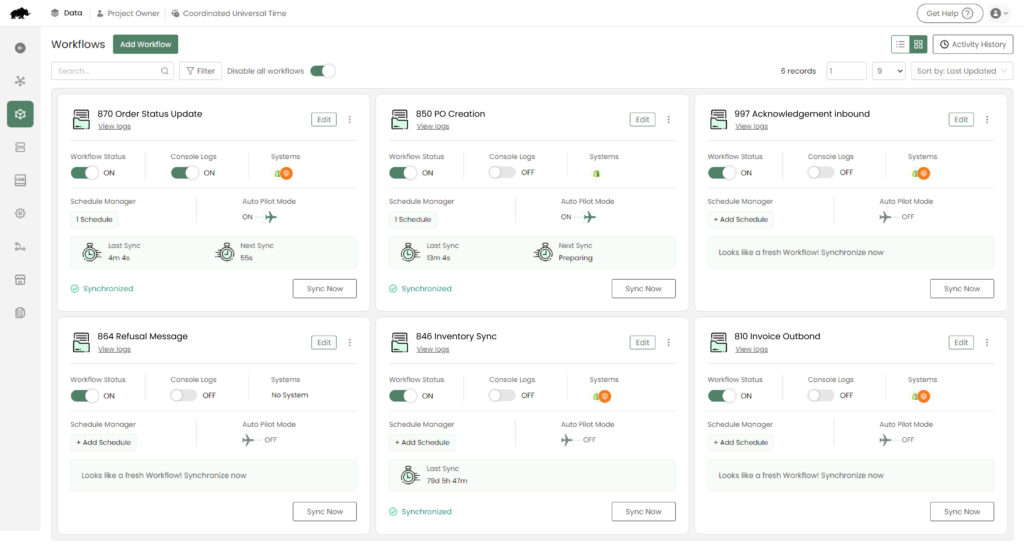

- Visibility and Control: With DCKAP Integrator, you gain more than just a tool for EDI; you get a comprehensive monitoring system. It provides detailed insights into each transaction, from order placement to invoice approval, helping you identify and address delays or errors promptly. This level of oversight is crucial for optimizing supply chain operations and enhancing overall efficiency.

- Ease of Use: Despite its robust features, DCKAP Integrator is designed with user experience in mind. The intuitive interface allows even those new to EDI to manage processes without intensive IT involvement, simplifying operations and reducing operational overhead.

If you’re looking to enhance your EDI capabilities, then DCKAP integrator is a worthy investment. With its combination of customization, comprehensive support, and ease of use, it’s designed to take your business’s efficiency and security to the next level.

Whether you’re looking to streamline your existing processes or build a robust EDI system from the ground up, DCKAP Integrator has you covered.

Contents